Coronavirus challenge redefines GM role

Audio: Session 293: https://longlivelodging.com/293-crisis-managers-coronavirus-challenge-redefines-gm-role/?utm_source=mailchimp-293#.X6QLqGhKguU

Note: Minute 33: David Miller, GM, Focus Management Hospitality

By: Judy Maxwell, Long Live Lodging, November 04

General Managers break time barriers as they work to keep hotel businesses afloat

Antonio Jones has been a general manager in hotels in several cities over the past 20 years. And he’s worked to save hotel businesses in the wake of disasters such as the terrorist attacks of 9-11 and Hurricane Katrina’s devastation of New Orleans in 2005.

These days, Jones is general manager of a dual-brand complex in Atlanta – the Staybridge Suites Atlanta Midtown and the Crowne Plaza Atlanta Midtown, which is managed by Spire Hospitality.

The management company is an affiliate of the property’s owner, AWH Partners LLC in New York City, which acquired the 500-room property in 2014 when it was branded as a Melia. Over the next two years, AWH Partners spent $20 million on renovating and repositioning the asset. InterContinental Hotels Group owns the brands. Staybridge Suites is an upscale extended-stay hotel and Crowne Plaza is an upper-upscale full-service property.

The complex’s seasoned GM is applying what he learned in previous challenging circumstances to keep the hotels operating.

Jones believes the U.S. hospitality industry will recover from the unprecedented downturn in business caused by the coronavirus pandemic, but it will take more than a year for performance to reach pre-pandemic levels. Until then, Jones is committed to the long haul.

“When you look at pre-COVID, we were always at a mindset how do we become innovative, how do we stay on the cutting edge and invest for the future. Right now, all those things are on hold,” Jones said. Keeping the hotels’ business solvent for the next six to 12 months is the most important thing right now, he said. “Every expense is critical.”

And that includes labor costs.

The staffing level at the property declined from 130 employees to 25. Tate and Teresa Sims, director of operations, are performing tasks they’ve had not had to do for years, including preparing meals, cleaning rooms and staffing the front desk.

They both stay take turns staying overnight at the hotel so they can be on hand for any issues that arise.

Occupancy was down in April and May, but business began to pick up in the summer. Tate said the increase in occupancy corresponded with the federal government’s stimulus-check distribution and its Pandemic Unemployment Assistance program, which gave people who lost jobs because of the coronavirus crisis $600 a week on top of their regular state unemployment benefits.

The increased business was welcomed but Tate said it was not enough to call all the hotel’s employees back. That meant Tate and Sims were turning rooms over when demand would surge, staying up until 2 a.m. to get the laundry done.

Profound Changes

Del Ross, chief revenue officer at Hotel Effectiveness, a technology company that helps hotels manage labor costs, said his research shows that general managers continue to go above and beyond a normal work week.

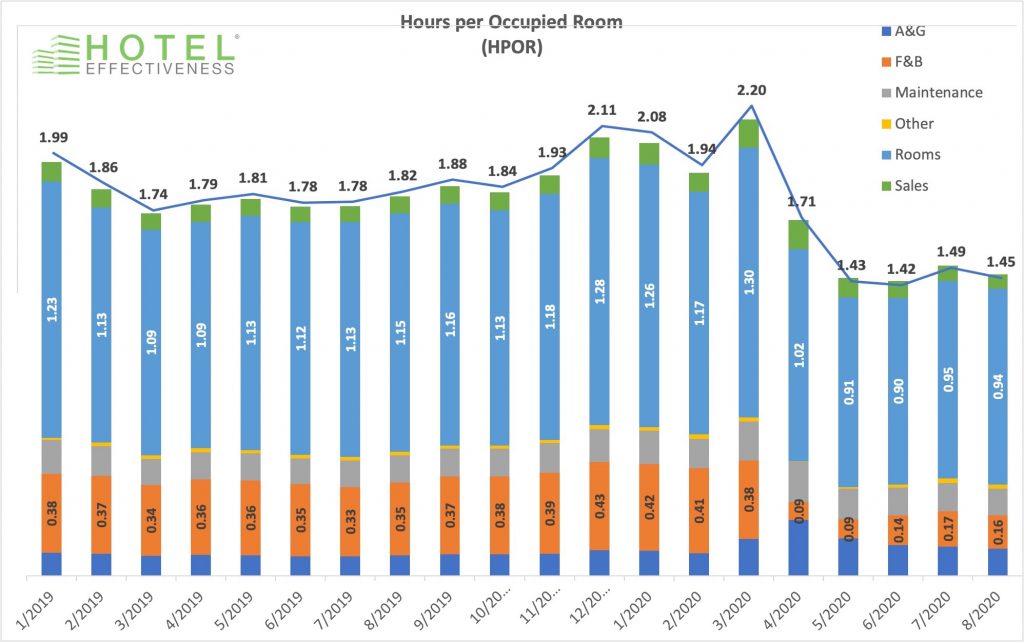

Hotel Effectiveness charted the division of labor by determining the number of hours per occupied room being worked at its clients’ hotels. The findings reveal the allocation of labor has dramatically changed from pre-pandemic to today, Ross said.

The biggest change is in food and beverage as most hotels have stopped or dramatically scaled back that department. But every worker role in the hotels has changed, and more so for assistant general managers and general managers. “That is the category where the change is quite profound,” Ross said. “It will be very interesting to see how long these changes stick around.”

Ross noted before the pandemic, hotels in Hotel Effectiveness’s data set broke down the average time invested per occupied room to one minute for assistant general managers and two minutes for general managers.

From mid-April to early May – the worst period of the COVID-19 pandemic – hotels were down to nearly zero staffing levels and minutes per occupied room for both assistant general managers and general managers sharply increased, 250 percent for assistant GMs and 272 percent for GMs.

The shift in work load makes sense, Ross said. But what he found surprising is that while general managers have called back an average of half the staff, their time spent at work has not decreased in tandem. “It’s still way, way up from what it was before the pandemic,” Ross said. “Seventy-eight percent higher for the assistant general manager and 86 percent higher for general manager.

“They’re spending nearly twice the amount of time per room as before the pandemic because they’re still doing multiple jobs.”

General managers continue to work the front desk and turn rooms and perform all kinds of tasks that were once the responsibility of hourly and salaried workers “not because they want to,” Ross said, but because “the variability of occupancy is so extreme and hard to predict the decision to add staff for these variable staffing roles like housekeeping and the front desk is not a trivial one.”

General managers don’t want to bring back hourly employees only to have to lay them off again if business drops off. “So they just knuckle down and clean another room,” Ross said. “I think as long as uncertainty in the market exists, they’re going to still do that.”

But they can’t keep on like this for long. “You can’t expect general managers who’ve reached the peak of their careers to unclog toilets forever.”

GM Revolution

Ross said he and others in the industry wonder how the pandemic roles of the general managers have changed for good, especially since the role had been a hard one for hotel owners to fill pre-pandemic.

In a September interview with Long Live Lodging, Ross said weaknesses in hotels’ on-property leadership were showing in the year or two before the coronavirus crisis struck. That’s because the unemployment rate in the U.S. was a record low of 3.5 percent and the hospitality industry was challenged with finding skilled employees – from line level workers to administration ranks.

As a result, many employees were being moved into management roles before they were truly ready to take on such responsibilities. The job proved too much for many of newly minted managers.

“A year ago when we were looking at the turnover rate in hotel employment, the highest turnover position in hotels at that time across the U.S. was assistant general manager,” Ross said. “We’re learning today that the lack of management depth is really hurting hotels right now. The gap between the experience of the general manager and experience level of a line-level manager is creating a great deal of stress and strain on the GM’s job.”

Ross expects a revolution among general managers once the worst of the pandemic is over and hotels get on the road to recovery.

“This was always a hard job, a high stress job. And it hasn’t gotten any easier,” he said. “Now add to it the burden of leadership that can’t be shared because of the lack of depth” of experience of other managers; the on-the-job risks and hazards that did not exist six months ago; and the added stressors of figuring out how to run a hotel business during a pandemic.

“We’re actually going to see a separation of the ranks of GMs,” Ross said. “There’s going to be a new definition of the job” and many of the changes will “endure going forward.”

Resources and Links

- David Miller at Focus Hospitality Management

- Antonio Jones and Alan Tate at Spire Hospitality

- Brittany Guevara at Zenique Hotels

- Del Rossat Hotel Effectiveness

- Bryan DeCortat Hotel Equities